missouri gas tax rebate

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Missouris gas tax is currently 195 cents a gallon.

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

JEFFERSON CITY Mo.

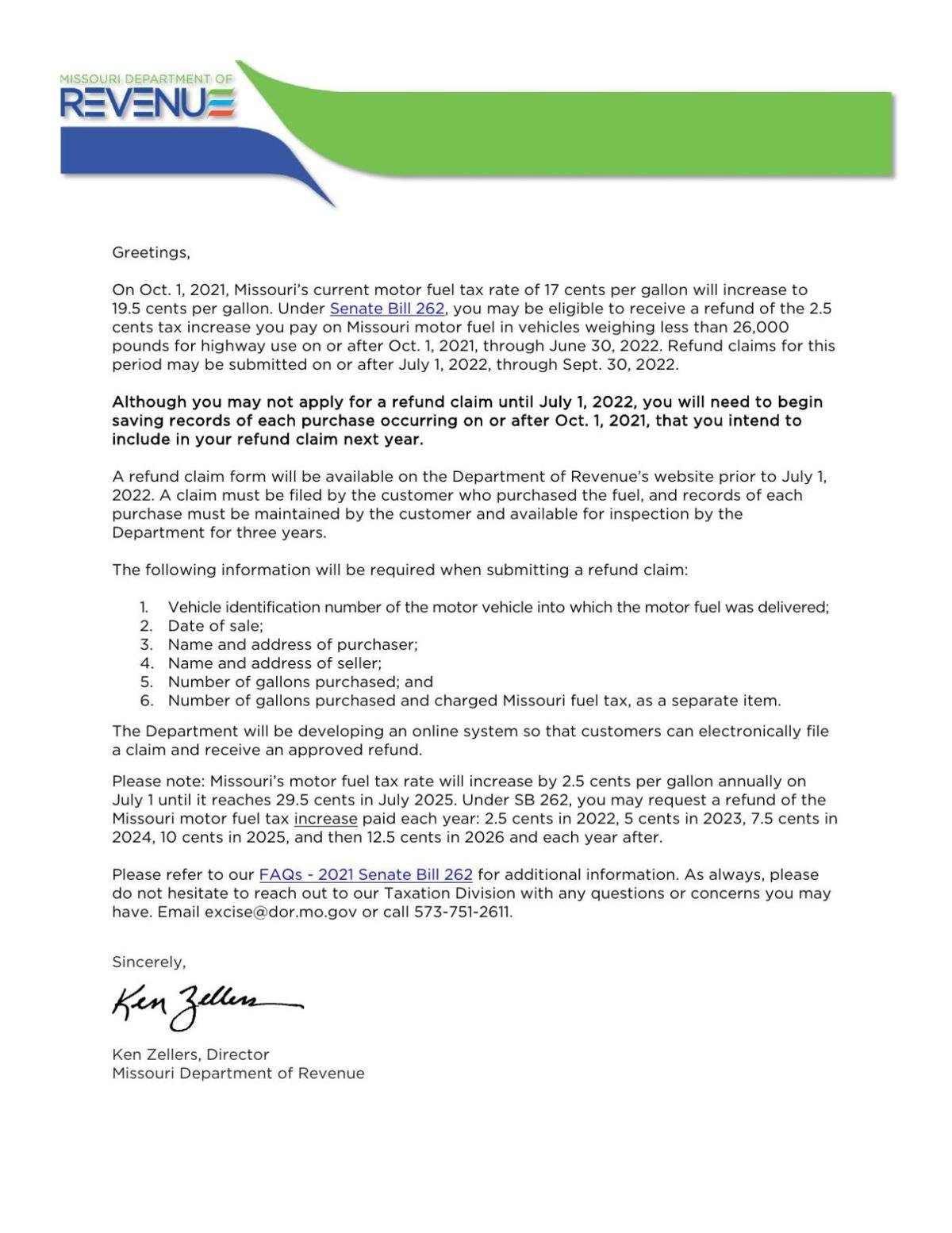

. The states additional gas tax went up to five cents a gallon July 1. For on road purposes. 25 cents in 2022 5 cents in 2023.

The bill also offers provisions that allow Missourians to request a refund once a year for refunds on the gas tax in the following amounts. Missouri drivers can start submitting refunds to receive the money they spent on a state gas tax just as the tax increases July 1. The tax is passed on.

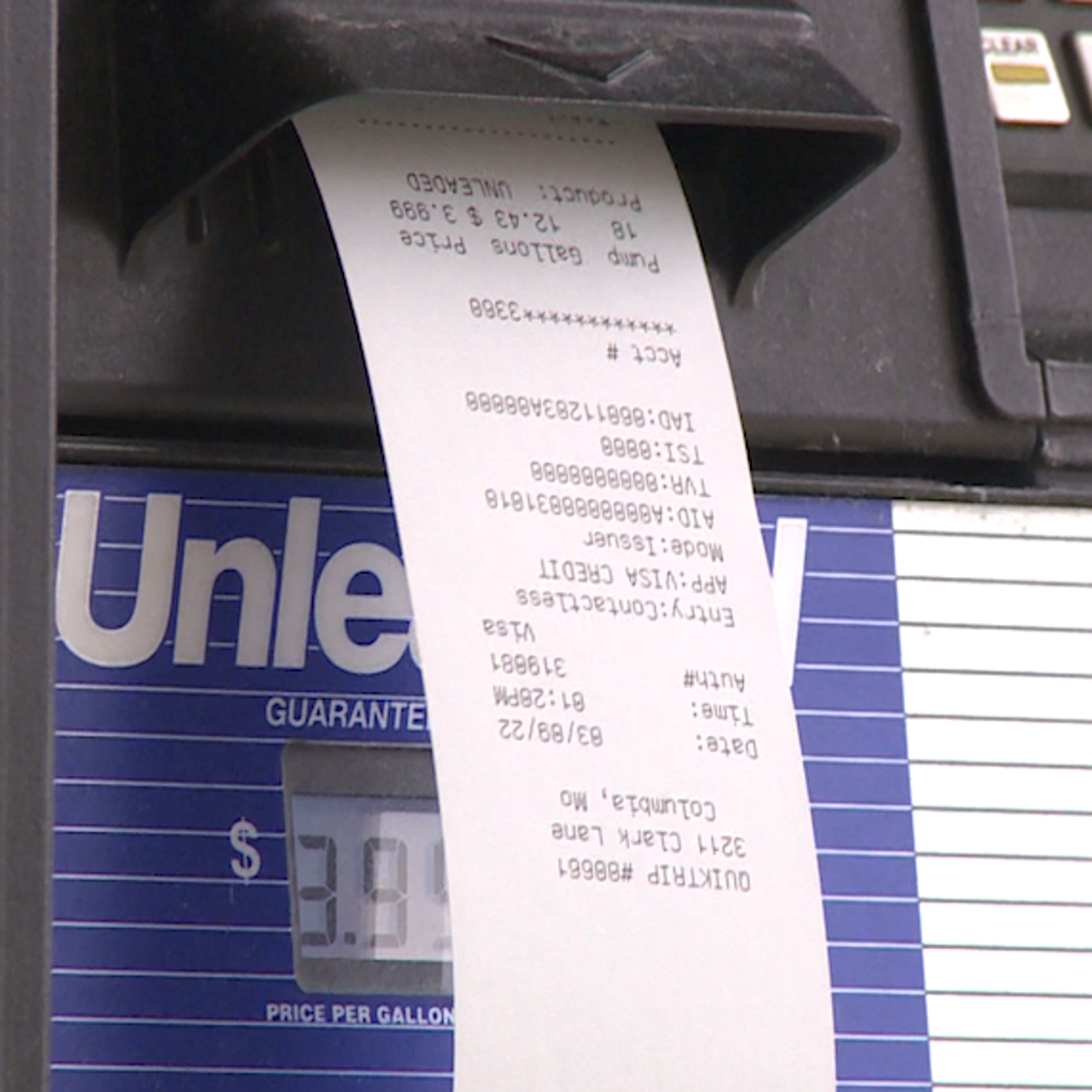

The taxpayer has paid 298 in motor fuel tax and may request a refund of that amount using Form 4923. What Does the Missouri Gas Tax Rebate Mean for You. A taxpayer purchases 21325 gallons of gasoline on October 25 2021.

Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. The money from this tax rate typically. The Business Journals Select a City.

Requests can be made for refunds from the motor fuel tax for the. To claim a refund for motor fuel tax paid on fuel used for exempt non-highway purposes the ultimate consumer or retailer must file the claim. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

NoMOGasTax app is built in response to Missouri Senate Bill 262 which imposed a progressive gas tax providing a Gas Tax Rebate. Avalara can simplify fuel energy and motor tax rate calculation in multiple states. Missouri drivers are getting their first chance to ask for money back from the states gas tax increase.

Purchased on October 1 2021 and on or before June 30 2022 with each refund claim Reefer Use. Use this form to file a refund claim for the Missouri motor fuel tax increase paid beginning October 1 2021 through June 30 2022 for motor fuel used. Starting July 1 Missouri residents can apply online to get a refund for a portion of the states two and a half cent fuel tax as part of Missouris fuel tax rebate program.

Missouri drivers can start submitting refunds to receive the money they spent on a state gas tax just as the tax increases July 1. Individuals who drive through or in Missouri could receive a refund for the increased gas taxes paid under a new plan put forth by Rep. Residents who earned under 100000 in 2021 -- or 200000 if they file jointly-- will get a 300 tax rebate this year with dependents eligible for the rebate as well.

The bill also offers provisions that allow Missourians to request a refund once a year for refunds on the gas tax in the following amounts. Under Senate Bill 262 you may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel in vehicles weighing less than 26000 pounds for highway use on or. 25 cents in 2022 5 cents in 2023.

July 1st 2022 Missouri gas tax increases to 022 --- 05. Every time you fill your vehicle with gas you pay a gas tax rate. Avalara can simplify fuel energy and motor tax rate calculation in multiple states.

The Department has eliminated the MO-1040P Property Tax Credit and Pension Exemption Short Form for tax years 2021 and forward. When the state of Missouri passed a law to increase its gas tax lawmakers also promised a refund to. Within one year of the date of purchase or.

List the number of reefer units that travel through or in Missouri. Missouri receives fuel tax on gallons of motor fuel gasoline diesel fuel kerosene and blended fuel from licensed suppliers on a monthly basis. For those who previously filed MO-1040P you will now.

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

Gas Tax Cut Again In Missouri Nextstl

Gas Tax Cut Again In Missouri Nextstl

Missouri Gas Tax Refund Forms Now Available Local News Bransontrilakesnews Com

How To File For Gas Tax Increase Rebate In Missouri Starting July 1

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Thousands File Gas Tax Refund Claims With Missouri Department Of Revenue Ksdk Com

Heat It Up 417 Home Winter 2015 Springfield Mo City Utilities Heat Springfield

State To Begin Accepting Gas Tax Refund Claims

Missouri Drivers Are Now Eligible To Start Filing For Their Gas Tax Refunds With The State Of Missouri Via The Nomogastax App

Missouri Fuel Tax Increase Goes Into Effect On October 1

App Can Help Missourians Easily Keep Track Of Gas Receipts State News Komu Com

New Gas Tax App For Missouri Connects Paperwork With Dept Of Revenue Refunds Listen Missourinet

Missouri Department Of Revenue Plans To Offer Money Back On Gas Purchases Koam

Missouri Residents Can Get Money Back Through Gas Tax Refund

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase